-

Study

-

Quick Links

- Open Days & Events

- Real-World Learning

- Unlock Your Potential

- Tuition Fees, Funding & Scholarships

- Real World Learning

-

Undergraduate

- Application Guides

- UCAS Exhibitions

- Extended Degrees

- School & College Outreach

- Information for Parents

-

Postgraduate

- Application Guide

- Postgraduate Research Degrees

- Flexible Learning

- Change Direction

- Register your Interest

-

Student Life

- Students' Union

- The Hub - Student Blog

- Accommodation

- Northumbria Sport

- Support for Students

-

Learning Experience

- Real-World Learning

- Research-enriched learning

- Graduate Futures

- The Business Clinic

- Study Abroad

-

-

International

International

Northumbria’s global footprint touches every continent across the world, through our global partnerships across 17 institutions in 10 countries, to our 277,000 strong alumni community and 150 recruitment partners – we prepare our students for the challenges of tomorrow. Discover more about how to join Northumbria’s global family or our partnerships.

View our Global Footprint-

Quick Links

- Course Search

- Undergraduate Study

- Postgraduate Study

- Information for Parents

- London Campus

- Northumbria Pathway

- Cost of Living

- Sign up for Information

-

International Students

- Information for International Students

- Northumbria and your Country

- International Events

- Application Guide

- Entry Requirements and Education Country Agents

- Global Offices and Regional Teams

- English Requirements

- English Language Centre

- International student support

- Cost of Living

-

International Fees and Funding

- International Undergraduate Fees

- International Undergraduate Funding

- International Masters Fees

- International Masters Funding

- International Postgraduate Research Fees

- International Postgraduate Research Funding

- Useful Financial Information

-

International Partners

- Agent and Representatives Network

- Global Partnerships

- Global Community

-

International Mobility

- Study Abroad

- Information for Incoming Exchange Students

-

-

Business

Business

The world is changing faster than ever before. The future is there to be won by organisations who find ways to turn today's possibilities into tomorrows competitive edge. In a connected world, collaboration can be the key to success.

More on our Business Services-

Business Quick Links

- Contact Us

- Business Events

- Research and Consultancy

- Education and Training

- Workforce Development Courses

- Join our mailing list

-

Education and Training

- Higher and Degree Apprenticeships

- Continuing Professional Development

- Apprenticeship Fees & Funding

- Apprenticeship FAQs

- How to Develop an Apprentice

- Apprenticeship Vacancies

- Enquire Now

-

Research and Consultancy

- Space

- Energy

- AI Futures

- CHASE: Centre for Health and Social Equity

- NESST

-

-

Research

Research

Northumbria is a research-rich, business-focused, professional university with a global reputation for academic quality. We conduct ground-breaking research that is responsive to the science & technology, health & well being, economic and social and arts & cultural needs for the communities

Discover more about our Research-

Quick Links

- Research Peaks of Excellence

- Academic Departments

- Research Staff

- Postgraduate Research Studentships

- Research Events

-

Research at Northumbria

- Interdisciplinary Research Themes

- Research Impact

- REF

- Partners and Collaborators

-

Support for Researchers

- Research and Innovation Services Staff

- Researcher Development and Training

- Ethics, Integrity, and Trusted Research

- University Library

- Vice Chancellors Fellows

-

Research Degrees

- Postgraduate Research Overview

- Doctoral Training Partnerships and Centres

- Academic Departments

-

Research Culture

- Research Culture

- Research Culture Action Plan

- Concordats and Commitments

-

-

About Us

-

About Northumbria

- Our Strategy

- Our Staff

- Our Schools

- Place and Partnerships

- Leadership & Governance

- University Services

- Northumbria History

- Contact us

- Online Shop

-

-

Alumni

Alumni

Northumbria University is renowned for the calibre of its business-ready graduates. Our alumni network has over 253,000 graduates based in 178 countries worldwide in a range of sectors, our alumni are making a real impact on the world.

Our Alumni - Work For Us

Top Budgeting Tips and Resources

By Jinan (Postgraduate Content Creator, Design MA)

So, the Cost-of-Living crisis is a thing now… And it can all be a bit stressful. However, there are lots of things Northumbria students can do to make it easier! Budgeting is important, and the good news is: it can be done without making you feel like you’re missing out on much. If you’re interested in finding out more about how to deal with your money, read on!

1. An Introduction to Budgeting:

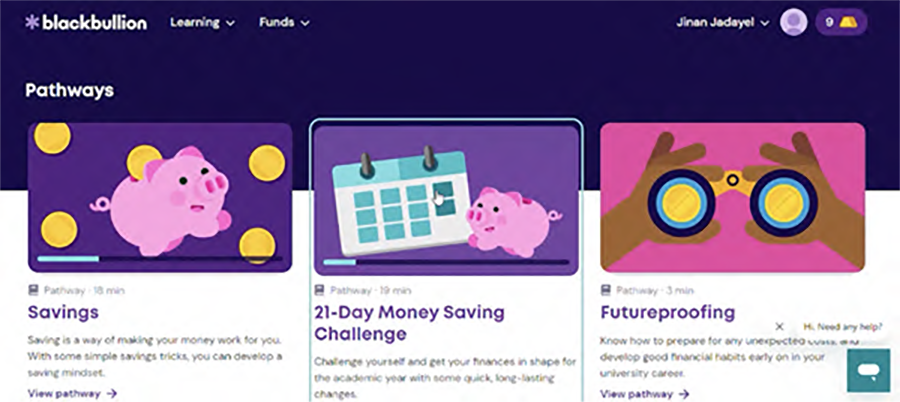

As a student, I know what it feels like being scared to check your bank account, and trying to stay positive about money. The first step to being comfortable with your money is understanding what you’re spending on: how much do you spend on needs, verses wants, verses going out, etc? I like to track my spending by immediately writing the amount down in my phone’s Notes app. Then, I’ll put all that into an Excel file I make for each month. This helps me understand how much money is going where. From there, I’m able to judge how much money I need to spend, and how much I can save. Another helpful resource to use for planning a budget is Blackbullion: an online platform that helps students learn about all things related to money. This platform was really helpful for me, as it includes a budget calculator, and money-saving challenges!

Also – making a budget doesn’t mean you’re missing out on fun stuff. There are so many free to inexpensive things to do around Newcastle with your friends. Walks by the quayside, using your student discount at coffee shops and even taking the metro to Tynemouth are all great examples of that.

2. Cost of Living

As the cost-of-living crisis gets worse, it’s really helpful understanding what the university and students’ union can offer. As Northumbria students, we can get access to fast wi-fi, hot water, warm spaces, and microwaves on campus, each of which have helped me control my spending.

3. Additional Costs

Make sure you count all additional student costs while tracking your spending. These are usually things you end up forgetting when trying to plan your budget, like subscriptions, monthly plans, society & gym memberships, field trips, and materials.

4. Debt

There are a number of resources that can help students understand and deal with debt, like: the National Debtline, The Money Advice Service, and the Money Saving Expert.

It’s helpful to know that you’re not alone in this struggle, and that there are always ways around it. We’re in this together!