-

Study

-

Quick Links

- Open Days & Events

- Real-World Learning

- Unlock Your Potential

- Tuition Fees, Funding & Scholarships

- Real World Learning

-

Undergraduate

- Application Guides

- UCAS Exhibitions

- Extended Degrees

- School & College Outreach

- Information for Parents

-

Postgraduate

- Application Guide

- Postgraduate Research Degrees

- Flexible Learning

- Change Direction

- Register your Interest

-

Student Life

- Students' Union

- The Hub - Student Blog

- Accommodation

- Northumbria Sport

- Support for Students

-

Learning Experience

- Real-World Learning

- Research-enriched learning

- Graduate Futures

- The Business Clinic

- Study Abroad

-

-

International

International

Northumbria’s global footprint touches every continent across the world, through our global partnerships across 17 institutions in 10 countries, to our 277,000 strong alumni community and 150 recruitment partners – we prepare our students for the challenges of tomorrow. Discover more about how to join Northumbria’s global family or our partnerships.

View our Global Footprint-

International Students

- Information for International Students

- Northumbria and your Country

- International Student Events

- Application Guide

- Entry Requirements and Education Country Agents

- Global Offices and Regional Teams

- English Requirements

- English Language Centre

- International student support

- Cost of Living

-

International Fees and Funding

- International Undergraduate Fees

- International Undergraduate Funding

- International Masters Fees

- International Masters Funding

- International Postgraduate Research Fees

- International Postgraduate Research Funding

- Useful Financial Information

-

International Partners

- Agent and Representatives Network

- Global Partnerships

- Global Community

-

International Mobility

- Study Abroad

- Information for Incoming Exchange Students

-

-

Business

Business

The world is changing faster than ever before. The future is there to be won by organisations who find ways to turn today's possibilities into tomorrows competitive edge. In a connected world, collaboration can be the key to success.

More on our Business Services-

Business Quick Links

- Contact Us

- Business Events

- Research and Consultancy

- Education and Training

- Workforce Development Courses

- Join our mailing list

-

Education and Training

- Higher and Degree Apprenticeships

- Continuing Professional Development

- Apprenticeship Fees & Funding

- Apprenticeship FAQs

- How to Develop an Apprentice

- Apprenticeship Vacancies

- Enquire Now

-

Research and Consultancy

- Space

- Energy

- AI Futures

- CHASE: Centre for Health and Social Equity

- NESST

-

-

Research

Research

Northumbria is a research-rich, business-focused, professional university with a global reputation for academic quality. We conduct ground-breaking research that is responsive to the science & technology, health & well being, economic and social and arts & cultural needs for the communities

Discover more about our Research-

Quick Links

- Research Peaks of Excellence

- Academic Departments

- Research Staff

- Postgraduate Research Studentships

- Research Events

-

Research at Northumbria

- Interdisciplinary Research Themes

- Research Impact

- REF

- Partners and Collaborators

-

Support for Researchers

- Research and Innovation Services Staff

- Researcher Development and Training

- Ethics, Integrity, and Trusted Research

- University Library

- Vice Chancellors Fellows

-

Research Degrees

- Postgraduate Research Overview

- Doctoral Training Partnerships and Centres

- Academic Departments

-

Research Culture

- Research Culture

- Research Culture Action Plan

- Concordats and Commitments

-

-

About Us

-

About Northumbria

- Our Strategy

- Our Staff

- Our Schools

- Place and Partnerships

- Leadership & Governance

- University Services

- Northumbria History

- Contact us

- Online Shop

-

-

Alumni

Alumni

Northumbria University is renowned for the calibre of its business-ready graduates. Our alumni network has over 253,000 graduates based in 178 countries worldwide in a range of sectors, our alumni are making a real impact on the world.

Our Alumni - Work For Us

Dr Tharyan is an Associate professor of Economics and Finance at the Newcastle Business School and is Associate Head of School - International and Educational Partnerships. He holds a PhD in Finance from the University of Exeter Business School and an MSc from the London School of Economics. He also holds an MBA in Finance and is a Fellow of the Higher Education Academy. He has extensive teaching experience at undergraduate and postgraduate level including on MBA programs. He has been a class teacher at the London School of Economics and a resident faculty at the Ecole Nationale des Ponts et Chausees (Now Ecole Paris Tech) India campus. He has also delivered courses at The Southwestern University of Finance and Economics (SWUFE), China and at the University of Algarve, Portugal.

He has published in leading journals such as the British Journal of Management, The British Accounting Review, Journal of Business Finance and Accounting, European Financial Management and the Journal of Business Ethics.

His research has been covered by Bloomberg and cited by the MSCI, The Times, The Economist, The Motley Fool, CityWire, BBC Radio4 Money Box among others. His research has also been cited in several regulatory reports of the Competition and Markets Authority (CMA).

His current research covers empirical asset pricing, block ownership, corporate debt – covenant lite contracts, trade credit, directors’ trading, mergers and acquisitions and ESG and corporate social responsibility.

Research Data

The UK equivalent of the Fama-French Five factor (Fama-French 2015) and Q-model (Hou et al. 2015) factors as described in Tharyan, Rajesh and Gregory, Alan and Chen, Biying, An investigation of multi-factor asset pricing models in the UK (2024).

Link to paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4933529

- Asset Pricing and Cost of Capital.

- Green Finance/ESG/ Climate finance/Corporate Social responsibility.

- Top Management Teams

- Block Ownership/Institutional Ownership

- Insider/Director’s trading.

- Mergers and Acquisitions

- Corporate Debt.

Current Working Papers

- Let There Be Liquidity: Automated market making in small stocks' markets (2025). (With P.Egloff, S. Graf and T. Krabichler) http://dx.doi.org/10.2139/ssrn.5147234

- Towards the Natural Environment Agency Theory (NEAT). (with G. Trojanowski and A. Shaukat) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4519832

- Real Menace or Crying Wolf? Covenant Flexibility and Risk-Return Dynamics of Covlites (With A. Isin and K. McMeeking) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4574171

- Covenant-lite Deals, Non-Bank Deal Ownership and Financial Reporting Quality” (With A. Isin and K. McMeeking)

- An investigation of multi-factor asset pricing models in the UK (With A. Gregory and B. Chen) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4933529

Industry Reports

- The Evolution of Beta through the Covid Crisis, January 2021 (With A. Gregory and R.D.F Harris)

- A Response to the CMA’s Provisional Findings on Water and the Estimation of Beta, October 2020. (With A. Gregory and R.D.F Harris)

- A Report on the Estimation of Beta, April 2020 (With A. Gregory and R.D.F Harris)

- A Report on the Cost of Equity, February 2019 (With A. Gregory and R.D.F Harris)

Other working papers and projects

- How does the stock market reward companies with a lower carbon footprint? (With S. Hua, A.Gregory and J. Whittaker)

- Paying cash? The effect of TMT international experience and national diversity on payment mode in cross-border acquisitions (with Trojanowski, D. Piaskowska and S. Ray)

- Overvaluation versus Overconfidence in takeovers: Managerial Trading as an Identification Strategy. (with A. Gregory and I. Tonks)

- Shareholders-vs-Stakeholders - Whose side are the managers on? - Evidence from India on the impact of Covid-19 on CSR activity. (With J. Jacob and B/ Balakrishnan)

Research Grants

- £9150-GW4, Starter grant for setting up a Centre for Corporate Governance and Social Responsibility (CGSR). Together with leads from Bristol, Bath and Cardiff universities, 2015.

- £285,000 -ESRC, “Cost of Capital and Asset Pricing in the UK”, with Gregory, C. Dargenidou, W. Pengguo, 2012-2015.

- Significant contribution to the bid and delivery of outcomes on a £75,000 – Leverhulme grant on "Examining insider trading around takeover announcements", 2008.

- £1,100 University of Exeter internal grant, Firms, Markets and Value (FMV) Cluster Funding for impact case study, 2016 (with A. Gregory)

- £2580 University of Exeter internal grant., Firms, Markets and Value (FMV) Cluster Funding to organize the cost of capital conference, 2017 (With P. Wang)

- £3500 University of Exeter internal grant., The Firms, Markets and Value (FMV) Cluster Funding for building a database of US mutual fund holdings by scraping original 13f/NQ etc. filings from SEC website, 2017 (With P.A Garcia)

- Please visit the Pure Research Information Portal for further information

- Environmental and social disclosures: Link with corporate financial performance, Qui, Y., Shaukat, A., Tharyan, R. 1 Mar 2016, In: British Accounting Review

- Experience Teaches Slowly: Non-linear Effects of Top Management Teams’ International Experience on Post-acquisition Performance, Piaskowska, D., Trojanowski, G., Tharyan, R., Ray, S. 3 Oct 2022, In: British Journal of Management

- In search of beta, Gregory, A., Hua, S., Tharyan, R. 1 Jun 2018, In: The British Accounting Review

- Corporate Social Responsibility and Firm Value: Disaggregating the Effects on Cash Flow, Risk and Growth, Gregory, A., Tharyan, R., Whittaker, J. 2014, In: Journal of Business Ethics

- Constructing and Testing Alternative Versions of the Fama-French and Carhart Models in the UK, Gregory, A., Tharyan, R., Christidis, A. 2013, In: Journal of Business Finance and Accounting

- Nishan Mallikarachchi Estimating Climate-Related Financial Risk Start Date: 01/10/2023

- Nishan Mallikarachchi Estimating Climate-Related Financial Risk Start Date: 01/10/2023 End Date: 17/10/2025

External Examining

- External Examiner at University of Bristol for the following UG modules.: EFIM 20041: Quantitative Methods for Finance 1, EFIM 20043: Asset Markets , EFIM 20040: Financial Data EFIM 20042: Corporate Finance and Valuation, EFIM30055: Advanced Topics in Finance, EFIM30056: Digital Finance, EFIM30054: Quantitative methods for Finance -2, EFIM30057: Risk Management

PhD Supervision

Current

- Karim Hende: (with P. Chandorkar), Babar Ahmad: (with D. Zhang), Nishan Mallikarchchi: (with Zary Aftab), Samuel Mazo (With N. Herzog)

Past Students

- Jinlin Li: “The impact of uncertainty on asset pricing and corporate finance decisions: evidence from US firms” (with C. Zhang) University of Exeter

- Suparna Ray: “Director experience implications for performance of mergers and Acquisitions.” (with G. Trojanowski) University of Exeter

- Huang Yan: “Long-term abnormal stock performance: UK evidence.” (with A. Gregory)

- Heba Ali: “Long run performance of initial public offerings and seasoned equity offerings in the UK.” (with A. Gregory) University of Exeter

- Graham Paul Buckingham: “ The Effect of Corporate Social Responsibility on the Financial Performance of Listed Companies in the UK.” (With A. Gregory) University of Exeter

- Shan Hua: “Relationship between firm valuation and corporate social responsibility initiatives.” (with A. Gregory) University of Exeter

PhD examination

As External Examiner

- Fatema Alrawahi: Workforce-Related Disclosure, its Determinants and Consequences for Workforce Outcomes and Corporate Performance of the FTSE 100 Firms', Brunel University, UK. (2023)

- Nishi M: Essays on SHG-Bank linkage programme, Indian Institute of Management Kozhikode, India (2023)

- Athira A.: Three essays on corporate tax management. Indian Institute of Management Kozhikode, India (2022)

- Heba Ahmed Hamza: The role of earnings and its components in predicting future cash flows: evidence from the MENA region firms, UWE Bristol (2020)

- John Chessher: Do insider returns vary with stock market conditions, Henley Business School (2019)

- Jie Tang: “The Financial Reporting Quality, choice of Payments and Due Diligence Auditor in M&As: Evidence from China” –Nottingham University Business School, Ningbo, China (2017).

- Ahmed Al-Omush: “The Association between Accruals, EVA and CVA and the Firm’s Market performance of UK and US firms” – University of West of England (2014)

As internal Examiner at Northumbria University

- Fiona Barnett: Towards a system approach to climate finance governance and coordination at the country level. (2024)

- Mikhail Vasenin: A data-driven approach to green investments: environmental performance, mispricing, and momentum (2022)

As internal examiner at University of Exeter

- Yintong Dai: “Three Essays on Stock Returns and Idiosyncratic Risk” (2022)

- Xiao Chen: Essays on Merger & Acquisition Press Releases and Firm Performance (2022)

- Yina Lian: “Essays in Pensions” (2019)

- Mengyu Wang: “Essays in Empirical Corporate Finance” (2019).

- Jian Liu: “Essays on Corporate Finance” (2018).

- Zezeng Li: “Essays on Pension De-risking Strategies” (2017).

- Xinlin Zhu: “Essays on corporate Diversification” (2016).

- Liang Liang: “The Impact of Innovation Networks on Service Design” (2016).

- Ruo Zhang: “Ambiguity Aversion and the Stock Market Participation: Empirical Evidence” (2016).

- Xingzhou Liu: “Stock return predictability and insider trades” (2013).

- Felix Haller: “Macro-Economic Forces, Managerial Behaviour and Board Networks as Drivers of M&A Activity” (2013).

- Kingkan Kestri: “Weather exposure and the market price of weather risk” (2012).

Leadership and Management Roles

- Newcastle Business School, Head of Finance subject group. 2022-

- Newcastle Business School, Deputy Head of the Department (Interim - Term1)

- Newcastle Business School, Director of Research and Knowledge Exchange. (Interim 2022- 2023)

- Exeter Business School Director of Post Graduate Research. 2017 – 2019

- Pathway lead for Business and Management, Exeter Business School -SWDTP 2017 – 2019

- Discipline Director of Post Graduate Research (Finance), Exeter Business School 2016 – 2017

- Academic Advisory Board member - ESRC SWDTP 2017 – 2020

- Placements Sub Panel Member - ESRC SWDTP 2017 – 2020

Awards and honourable mentions

- Environmental and social disclosures: Link with corporate financial performance (with Y. Qiu and A. Shaukat), The British Accounting Review, vol. 48, no. 1, pp. 102–116, 2016 (Most cited BAR paper 2016-2019 and second most cited paper of all time in the BAR in 2022)

- Above and Beyond Award (Impact), University of Exeter 2020

- Above and Beyond Award (Community), University of Exeter 2019

- Above and Beyond Award (Impact), University of Exeter 2019

- Above and Beyond Award, University of Exeter 2018

- Above and Beyond Award, University of Exeter 2017

- Above and Beyond Award, University of Exeter 2017

- Rewarding Excellence Incremental Award, University of Exeter 2016

- Above and Beyond-Award (Collaboration), University of Exeter 2016

- Above and Beyond-Gold Award (Exceptional performance at a University level), University of Exeter 2016

- Nominated – Students’ Guild teaching awards – best lecturer, University of Exeter 2016

- Nominated – The Business School awards, University of Exeter 2016

- Nominated – Students’ Guild teaching awards – best lecturer, University of Exeter 2015

- Nominated – Students’ Guild teaching awards – best lecturer, University of Exeter 2014

- Nominated – Students’ Guild teaching awards – best lecturer, University of Exeter 2012

- Full Departmental Scholarship for the Doctoral Program, University of Exeter 2004 – 2008

- Graduate Teaching Assistantship, University of Exeter 2004 – 2008

Media and other coverage of research

- Foundation of ESG investing, MSCI, Part 1- How ESG Affects Equity Valuation, Risk And Performance, MSCI (2019)

- Reports of the Competition and Markets Authority, (Various years)

- Wright, S., Burns, P., Mason, R. and Pickford, D., Estimating the cost of capital for implementation of price controls by UK Regulators, report for the UK Regulators Network .(UKRN). 2018.

- Is the stock market sexist? Pacific Standard Magazine, 25/1/2016.

- Cited in Great Debates in Company Law, by Lorraine Talbot, Palgrave Macmillan,

- NASDAQ - “For Better Returns, Invest Like a Woman”, 13/8/2013

- The 30 percent club suggested reading on the gender diversity on corporate

- London Economics Consultation Response Document to

- The Economist – Investing; Men: they just don’t listen, 6/6/2013

- The Times - Why banks like to say yes when women ask to borrow money, 8/6/2013

- The Herald (Glasgow) – Female stock trades valued less, 7/6/2013

- The Daily Record–Women best at share deal, 6/6/2013

- The Daily Mirror – Women best at share deal, 6/6/2013

- Daily Express – Morning meeting, 6/6/2013

- Annexes to the impact assessment on costs and benefits of improving the gender balance of companies listed on stock exchanges. Accompanying the initiative to improve gender balance in company boards, European Commision staff working document, Brussels, 14/11/2012.

- Gender diversity on company boards– VOX-CEPR policy portal, March 2012

- How female directors move the market, Business Spectator, 29/3/

- Stock market stereotypes undervalue female directors in the short-term: Phys.org, 24/2/2012.

- Following director's trades can make you money: Bloomberg, 5/01/2010

- Follow these canny share buyers: The Motley Fool, 19/12/2009.

- Tracking director share buying can make you money: CityWire, 15/12/2009.

- Insider trading in value and glamour stocks: BBC Radio4 Money BOX, 2/12/2009

- Please visit the Pure Research Information Portal for further information

- Google Scholar

- The aim of this data-page is to make available the equivalent of the Fama-French Five factor (Fama-French 2015) and Q-model (Hou et al. 2015) risk factors for the UK market as described in Tharyan, Rajesh and Gregory, Alan and Chen, Biying, An investigation of multi-factor asset pricing models in the UK (2024). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4933529

Our Staff

- Abderrahmen Trichili

- Adnan Tariq

- Alex Tinning

- Ayse Ozbil Torun

- Callum Thomson

- Chuleekorn Tanathitikorn

- Claire Thornton

- Devendra Tiwari

- Linda Taylor

- Emma Thirkell

- Emma Thomas

- Fabio Tronchetti

- Fatih Tuysuz

- Gavin Tempest

- Gillian Telford

- Graeme Turnbull

- Guy Tucker

- Hamdi Torun

- Harriet Todd

- Jamie Taylor

- Jasmin Turner

- Jing Tang

- Kunyapat Thummavichai

- Marco Tomietto

- Mark Telford

- Martin Tovee

- Matthew Townson

- Mike Taverne

- Mohamed Tharwat

- Morena Tartari

- Niraj Thurairajah

- Phil Thomas

- Rajesh Tharyan

- Reeba Thomas

- Reem Refaat Talhouk

- Sue Turner

- Waseem Toraubally

Latest News and Features

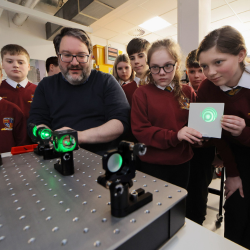

University partnership brings space research to life for school pupils

A North East school has partnered with solar and space physics experts from Northumbria University…

.png?modified=20250916102106)

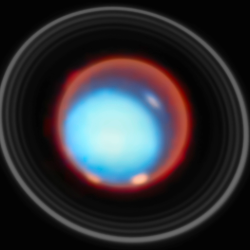

Telescope reveals surprising secrets in Jupiter's northern lights

An international team of scientists, led by a PhD researcher from Northumbria University, has…

Northumbria Film graduates receive Royal Television Society honours

Two Northumbria University Film graduates have won Royal Television Society (RTS) Student Awards…

Scientists reveal the best and worst-case scenarios for a warming Antarctica

A new analysis of decades of research on the Antarctic Peninsula, involving experts from Northumbria…

PhD student maps mysterious upper atmosphere of Uranus for the first time

A Northumbria University PhD student has led an international team of astronomers in creating…

Developing technology to help empower young innovators across the globe

Northumbria University researchers have joined forces with the International Federation of…

Upcoming events

Launch of the Northern Interprofessional Education Strategy

Northumbria University

-

Broken Bonds: New Perspectives on Marital Breakdown

The Great Hall

-